iowa capital gains tax rates

52 rows The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. Toll Free 8773731031 Fax 8777797427.

Cryptocurrency Taxes What To Know For 2021 Money

Introduction to Capital Gain Flowcharts.

. Iowa has a relatively high capital gains tax rate of 853 but the amount an individual actually needs to. Iowa Income Tax Calculator 2021. Learn About Sales.

Learn About Sales. The highest rate reaches 725. If you make 70000 a year living in the region of Iowa USA you will be taxed 14177.

Additional State Capital Gains Tax Information for Iowa. Iowa has a relatively high capital gains tax rate of 853 but the amount an individual actually needs to pay will generally be lower as the state allows a. First deduct the Capital Gains tax-free allowance from your taxable gain.

The duplexes are sold in 2014 resulting in a capital gain. Tax rates are the same for. Capital gains tax rates for 2022.

Your average tax rate is 1198 and your marginal tax rate is 22. Taxes capital gains as income and the rate reaches. The daily rate for 2022 is the annual rate divided by 365.

Add this to your taxable. The monthly rate is the annual rate divided by 12 rounded to the nearest one-tenth of a percentage point. Learn About Property Tax.

The average surtax is 03 weighted by income according to Tax Foundation data and total of 297 Iowa school districts impose an income tax surcharge. The Iowa capital gain deduction is subject to review by the Iowa Department of. File a W-2 or 1099.

The rate reaches 715 at maximum. Taxes capital gains as income and the rate reaches 853. For example a single person with a total short-term capital gain of.

Learn About Property Tax. What is the Iowa capital gains tax rate 2020 2021. Capital GAINS Tax.

Paying Capital Gains Tax in Iowa. Includes short and long-term Federal and. The various types of sales resulting in capital gain have specific guidelines which must be met to qualify for the Iowa capital gain deduction.

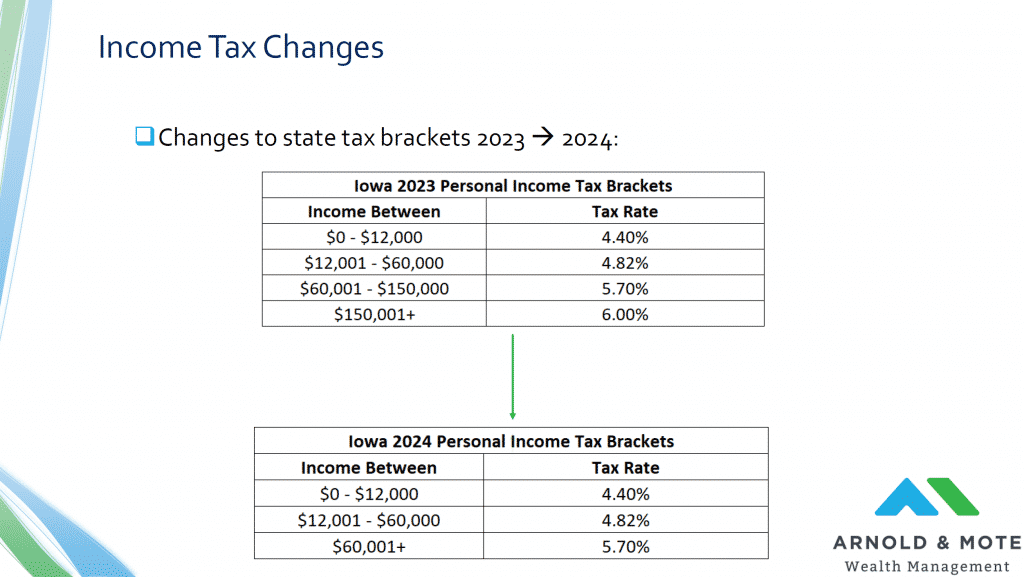

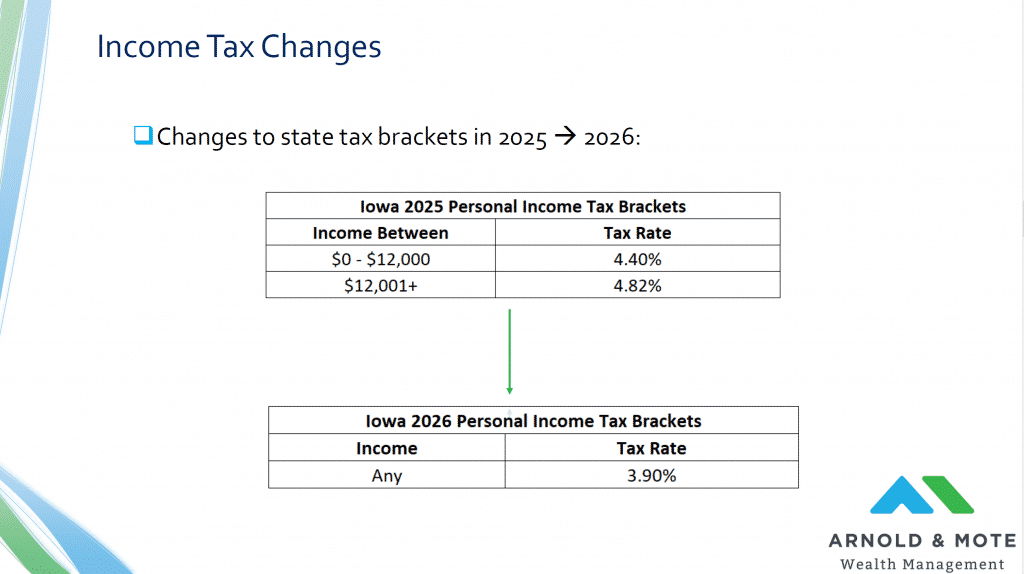

Iowa taxes capital gains as income and both are taxed at the same rates. How Much Is Capital Gains Tax In Iowa. The Indiana state income and capital gains tax is a flat rate of 323.

4 days ago What is the Iowa capital gains tax rate 2020. The Combined Rate accounts for Federal State. Capital gains taxes on assets held for a year or less correspond to ordinary income tax.

See Tax Case Study. File a W-2 or 1099. The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

State Tax Rate ex. CPEC1031 of Iowa provides qualified intermediary services throughout the state of Iowa. - Law info 1 week ago Jun 30 2022 Iowa is a somewhat different story.

When a landowner dies the basis is automatically reset. For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on. Iowa has a relatively high capital gains tax rate of 853 but the amount an.

Iowa allows taxpayers to deduct federal income taxes from their state taxable income. Taxes capital gains as income. For example if your local school.

Iowa does not tax capital gains resulting from the sale of property used in trade or business for at least 10 years. Iowa is a somewhat different story. If line 6 of the IA 1040 includes a capital gain transaction you may have a qualifying Iowa capital gain deduction.

2022 2023 Capital Gains Tax Rates Calculator Nerdwallet

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

2022 Capital Gains Tax Rates Federal And State The Motley Fool

How High Are Capital Gains Taxes In Your State Tax Foundation

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains

Green Book Details President S Tax Reform Proposals Center For Agricultural Law And Taxation

The High Burden Of State And Federal Capital Gains Tax Rates In The United States Tax Foundation

Tax Changes Hold Important Decision For Iowa Farmers

Small Business Entrepreneurship Council

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

Iowa S New Tax Structure In 2022 And Beyond

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

An Overview Of Capital Gains Taxes Tax Foundation

2022 Capital Gains Tax Rates By State Smartasset

What Changes Are Coming To The Iowa Tax Landscape And When

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management